The Fundamentals of Yield Management & Dynamic Pricing

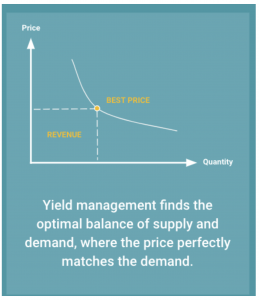

Finding that sweet spot where your price perfectly matches the demand is when your rates will “yield” the most amount of sales and revenue.

Yield management is a variable pricing strategy based on the principle of maximizing the revenue from a fixed, limited resource. It finds the optimal balance of supply and demand, where the price perfectly matches the demand. This is the sweet spot where your rates will “yield” the highest number of demand at the highest possible price. If you order an Uber at three different times of the day - you’ll get three different rates, depending on the number of cars available (supply) and the amount of people who requested a ride (demand). That is a yield management pricing strategy.

Yield Management and Parking

Yield management pricing strategies work best when the following conditions are met:

- Inventory is perishable

- Product is sold in advance

- Demand fluctuates

Industries where yield management strategies work well include: ride share, hotels, airline, and parking. All have a fixed amount of inventory that needs to be priced based on the demand and the remaining amount of inventory available. If a can of soda is on the shelf one day and sold the next day - there is no loss. Whereas, a parking spot is open all day - that revenue is lost forever, making yield management strategies vital in parking.

Traditional Pricing Strategies

For decades, the pricing of parking inventory has been largely based on: competition, location, and historical performance. It does not consider the demand of the market nor does it price inventory appropriately given the remaining daily supply. Typically, prices are updated yearly, seasonally, or at best - monthly. It is a slow and time-consuming process that is inefficient and leaves thousands of dollars on the table monthly. In today’s world, since this process can be automated, companies that rely on traditional pricing methods will soon find themselves edged out by the competition.

The Mobile Movement in Parking

It’s estimated that about 30% of traffic is caused by drivers searching for parking. To reduce the congestion and stress that comes with looking for an available spot, the demand for parking reservation apps is growing, and now more than ever, commuters are reserving their space before they leave their home. Overall the U.S. is behind the curve in terms of adopting mobile reservations, currently under 20%. In China, over 90% of parking transactions are processed online. Currently, the US parking market is a $131 billion dollar industry and is only growing. It’s estimated that within the next 10 years, more than half of all US parking transactions will be completed digitally. The direction of the parking industry is clear - it’s critical to expand your parking operations to online channels. Your competitors will continue to improve their online presence and shift parkers away from your facilities. Behaviors are changing - commuters are searching and securing spots before they go.

Do Online Sales Channels Cannibalize Transient Traffic?

One of the major hesitations operators have with online reservations apps is the perception that the online traffic is taking away, or converting, their transient visitors. However, after a year and hundreds of thousands of transactions, the data consistently shows a neutral impact on transient demand. Most drivers have their preferred method of parking - either drive-up or pre-paid reservation. Visitors that prefer to just drive-up continue to do so, and those who use reservation apps, consistently use the app when visiting new or repeated locations. It’s very rarely the case that drivers check and compare both options. By opening up spaces on an online sales channel, you’re simply allowing a new segment of visitors to find your garage.

A recent doctoral study by Todd Tucker, SVP of Market Development at Arrive, showed that online sales channels proved to create additional demand parking. The study was conducted at 30 parking locations, over the course of 180 days, totaling 5,400 total observations.

Results Of The Study Indicated That Online Sales Channels:

- Contribute a significant amount of revenue contributor to brick-and-mortar facilities

- Improve revenue per space

- Attracted new commuters

- Do not cannibalize the demand of transient parkers

Implementing Yield Management in Your Parking Operations

To effectively implement a yield management strategy, you need to have an idea of how changing the pricing will affect the demand for your product.

- High demand = higher price to optimize the revenue opportunity

- Low demand = lower price to encourage and increase demand

But by how much?

How high can the rate increase before the cost makes commuters turn away and returns diminish? To determine this, it’s important to monitor the change in the number of transactions after a rate change has been implemented. You can take the percentage change and divide it by the percentage change in price. The challenge with this approach is that it’s virtually impossible for a human to do this fast enough to keep up with the rapidly changing demands of the market. Now that demand data has become available, parking operators can enable and automated a true demand-based pricing approach.

Continue reading here.

Sarah Ortega

Smarking

+1 480-307-7907

email us here

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.